Paul Andreassen

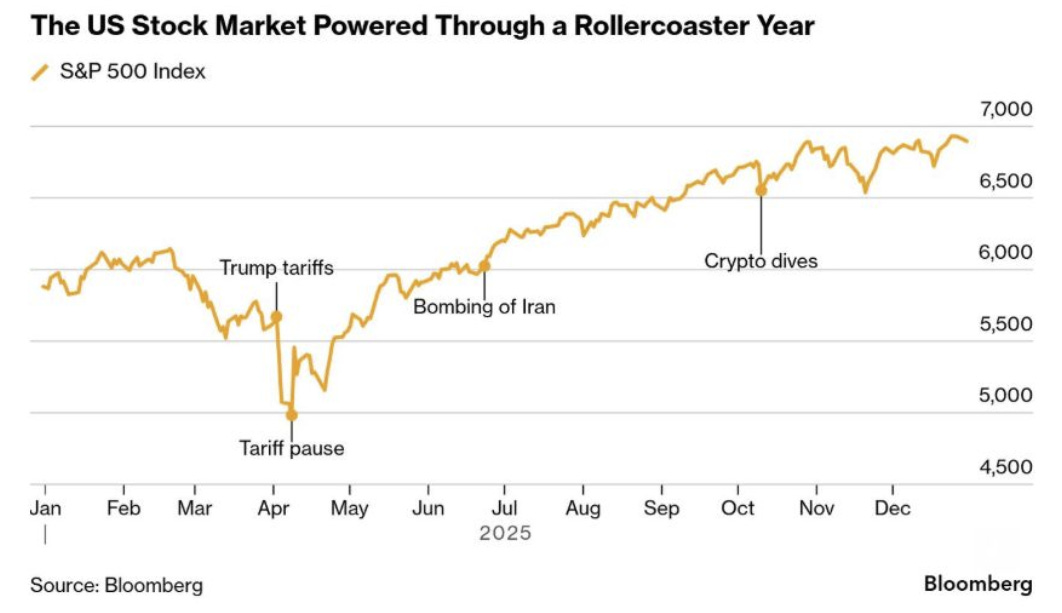

The market's performance in 2025 (once again) confirmed psychologist Paul Andreassen's findings from nearly 40 years ago.

In 1987, psychologist Paul Andreassen conducted a study that has earned him a place on the Mount Rushmore of investment research. He created a simulated trading environment and gave participants funds to invest.

He split participants into two groups: The first received regular news on their investments and were permitted to make trades based on the information they received. The second group were also permitted to trade if they wished, but didn’t receive any news on their investments.

The counterintuitive finding: Those who received no information on their investments ended up making better trading decisions than those who were better informed. More information, it turns out, causes investors to place more frequent trades, and these trades end up being counterproductive.

Why? Successful stock trading requires investors to be right twice: First, they need to make the correct investment choice, then they also need to time their trades correctly. In other words, an investor can buy the right stock at the wrong time and still end up losing money. The market’s volatile path in 2025 is the latest illustration of why this is so hard.

Jack Bogle used to say, “Don’t do something; just stand there.” It was good advice then, in my opinion, and good advice now.